Navigating through different stages of life requires careful financial planning, akin to charting a course through changing landscapes. Unlike planning a weekend getaway, financial planning demands a thorough understanding of various factors at play. From managing everyday expenses to preparing for major life events, each stage brings its own set of challenges and opportunities.

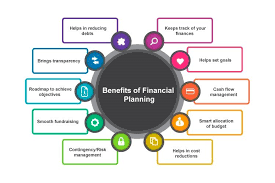

Financial planning is the process of managing your money to achieve specific goals and objectives. It involves assessing your current financial situation, identifying your goals, and creating a strategy to meet those goals. This comprehensive approach helps individuals make informed decisions about their finances, leading to greater financial security and peace of mind.

Assessment: Financial planning begins with a thorough assessment of your current financial situation, including income, expenses, assets, and liabilities. This stage assists you in assessing your financial situation and pinpointing areas that require improvement.

Goal Setting: Setting clear financial goals is crucial for effective planning. Whether it's buying a home, saving for education, or planning for retirement, defining your objectives gives you a roadmap to follow and motivates you to stay on track.

Budgeting: Creating a budget allows you to track your income and expenses, ensuring that you live within your means and allocate resources towards your priorities. A well-defined budget serves as the foundation of your financial plan.

Risk Management: Assessing and managing financial risks, such as market volatility, inflation, and unexpected expenses, is an integral part of financial planning. Strategies like insurance and diversification help mitigate potential risks and protect your financial well-being.

Investment Planning: Developing an investment strategy tailored to your goals and risk tolerance is essential for long-term wealth accumulation. Whether it's stocks, bonds, mutual funds, or real estate, choosing the right investment vehicles plays a crucial role in achieving your financial objectives.

Retirement Planning: Planning for retirement involves estimating your future expenses, determining your retirement income needs, and creating a savings plan to achieve those goals. Starting early and regularly contributing to retirement accounts are key principles of retirement planning.

Financial Security: Financial planning provides a sense of security by helping individuals build emergency funds, pay off debts, and accumulate savings for the future.

Goal Achievement: By setting clear financial goals and creating a roadmap to achieve them, financial planning empowers individuals to turn their dreams into reality, whether it's buying a home, funding education, or traveling the world.

Peace of Mind: Knowing that you have a solid financial plan in place gives you peace of mind, allowing you to focus on other aspects of your life without worrying about money.

Adaptability: Financial planning is not a one-time activity but a dynamic process that evolves with changing circumstances. By regularly reviewing and adjusting your plan, you can adapt to life's twists and turns and stay on course towards your goals.

Financial planning is a crucial aspect of achieving financial well-being at every stage of life. By understanding its importance, embracing its features, and reaping its benefits, individuals can navigate through life's journey with confidence and financial security.